“Startup is like riding a tiger. Others think that you’re brave for consciously taking on the tiger, while you wonder how you got there and pray you’d not be eaten,” mused Kelvin Teo, the 29-year-old co-founder of Funding Societies, to Vulcan Post.

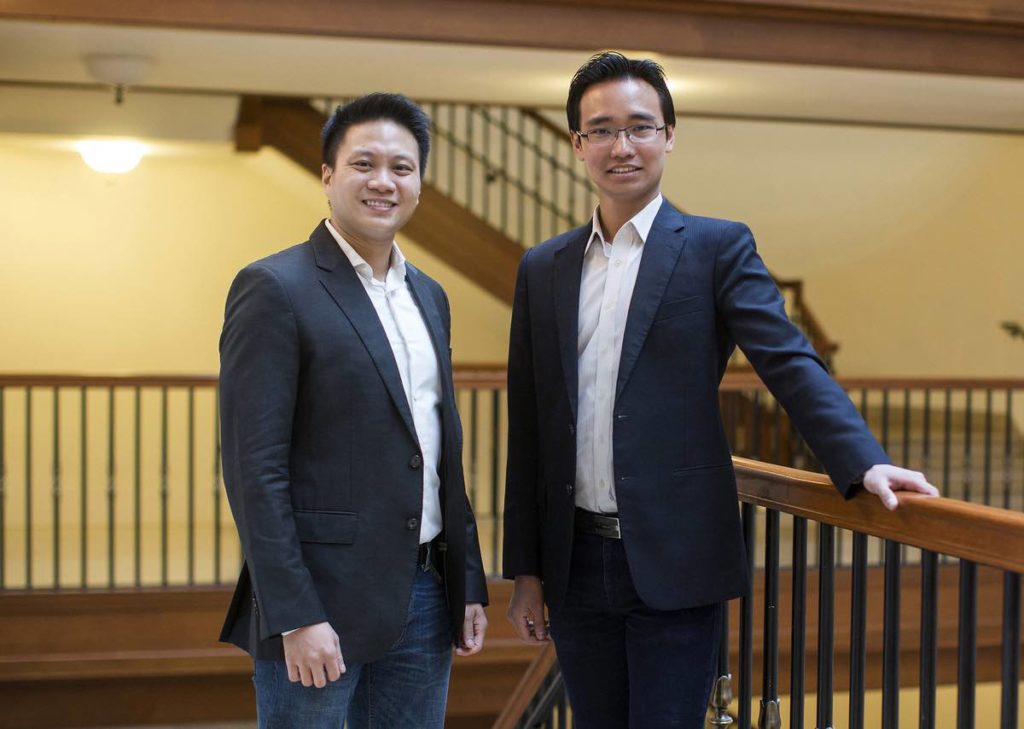

Reynolds Wijaya (L) and Kelvin Teo (R), Co-Founders of Funding Societies (Photo Credit: Scott Eisen/Bloomberg)

Kelvin, named after the home appliance brand Kelvinator, met co-founder Reynold Wijaya (27) during his first week at Harvard Business School. Together, the duo started Funding Societies, a fintech peer-to-peer lending platform that assists small and medium businesses. These youngsters when they began had their operating offices in a tunnel between buildings on Harvard’s campus. They now have 39 employees and have arranged S$5.5 million (US$4.1 million) in loans. Funding Societies charges a mere 3 to 4 per cent origination fee to borrowers and retains 1 per cent of repayments to investors. They are now expecting a legal partnership with DBS.

Funding Societies’s Journey

Kelvin and Reynold, who graduate from HBS in a few weeks, have raised $1.2 million from VCs in Singapore and Jakarta. Kelvin graduated as the valedictorian of NUS Business School in 2010 with first-class honours. During his time at NUS, he also went on a 1-year exchange program to University of Pennsylvania’s Penn Engineering and Wharton schools. He has worked in consulting at Accenture and McKinsey’s Singapore offices and thereafter worked as a Capstone Analyst at KKR. Reynolds pursued his bachelor’s and master’s degrees in industrial and operational engineering from University of Michigan from where he graduated Summa Cum Laude. At HBS, Reynolds is the Social Chair for the Asia Business Club.

It all started when Kelvin who was building a web based peer-to-peer lending start-up for the demands of his curriculum, happened to pitch the idea of his project to a potential partner, DBS Group Holdings Ltd, one of the leading South Asian banks. The CEO Piyush Gupta, unaware of Kelvin being a postgraduate student, went through his email and replied back immediately saying, “Interested”. Kelvin then collaborated with fellow classmate Reynolds and together they elevated their start-up globally with a vision to connect investors with borrowers from regular and medium sized businesses.

Funding Societies’s biggest investor is Indonesia-based Alpha JWC Ventures and its managing partner and co-founder, Will Ongkowidjaja, learned about Funding Societies through former McKinsey employees. He said, “The guys are really aggressive and their execution is very quick. They are very focused on doing the right thing and having social impact.”

Future of FinTech in South-East Asia

Freenyan Liwang, president director at PT Bank Sinarmas, who also tried to grab a contract with the young entrepreneurs said, “We are now into a digital era and all these young people can make it happen. I am 50-something — I have to learn from them.” In February, the bank became a security agent for the firm.

Financial technology firms have grown exponentially in South-East Asia and banks prefer to collaborate with fintech firms as opposed to losing a large part of their business to them. “The disruption of the financial sector is clearly underway,” expressed Pricewaterhouse Coopers in a report last month. “Given the speed of technology development, incumbents cannot afford to ignore fintech.”

HBS’s Entrepreneurial Ecosystem

Kelvin and Reynolds have benefited from HBS’s entrepreneurial ecosystem with courses such as FIELD, an acronym of Field Immersion Experiences for Leadership Development, where students create a product or service aimed at an international partner.

These two lads are not only inspirations for other MBA students and aspirants aspiring to change the world but also demonstrate the revolutionary changes fintech firms can bring into an entire industry.